Global Markets: Asian stock markets: Nikkei up 0.60 %, Shanghai Composite and Hang Seng both rose 0.05 %, ASX 200 gained 0.10 % Commodities: Gold at $1240 (-0.35 %), Silver at $18.12 (-0.50 %), WTI Oil at $50.25 (-0.20 %), Brent Oil at $53.00 (-0.20 %) Rates: US 10-year yield at 2.42, UK 10-year yield … Continue reading Friday 31st March: European Open Briefing

Category: Uncategorized

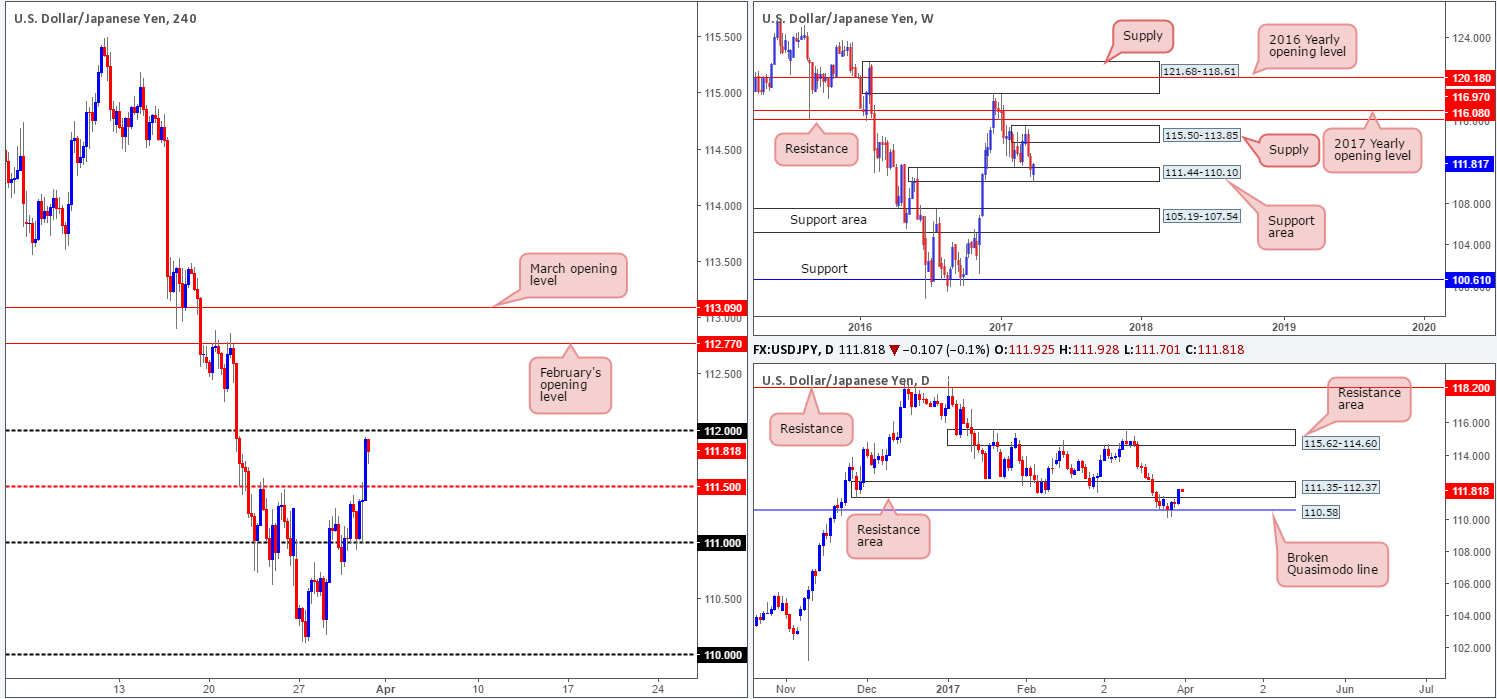

Friday 31st March: Technical outlook and review

A note on lower-timeframe confirming price action… Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the … Continue reading Friday 31st March: Technical outlook and review

Tomb-Sweeping Day Schedule

Dear Trader, Please find our updated trading schedule for the Tomb Sweeping day Holiday on Tuesday April 4th, 2017. All times mentioned below are Platform time( GMT +3) If you have any questions or require any assistance, please contact one of our support team members via Live Chat, email: support@icmarkets.com, or phone … Continue reading Tomb-Sweeping Day Schedule

Thursday 30th March: European Open Briefing

Global Markets: Asian stock markets: Nikkei down 0.35 %, Shanghai Composite lost 1.10 %, Hang Seng declined 0.50 %, ASX 200 gained 0.35 % Commodities: Gold at $1249 (-0.40 %), Silver at $18.17 (-0.45 %), WTI Oil at $49.50 (-0.05 %), Brent Oil at $52.45 (-0.20 %) Rates: US 10-year yield at 2.39, UK 10-year … Continue reading Thursday 30th March: European Open Briefing

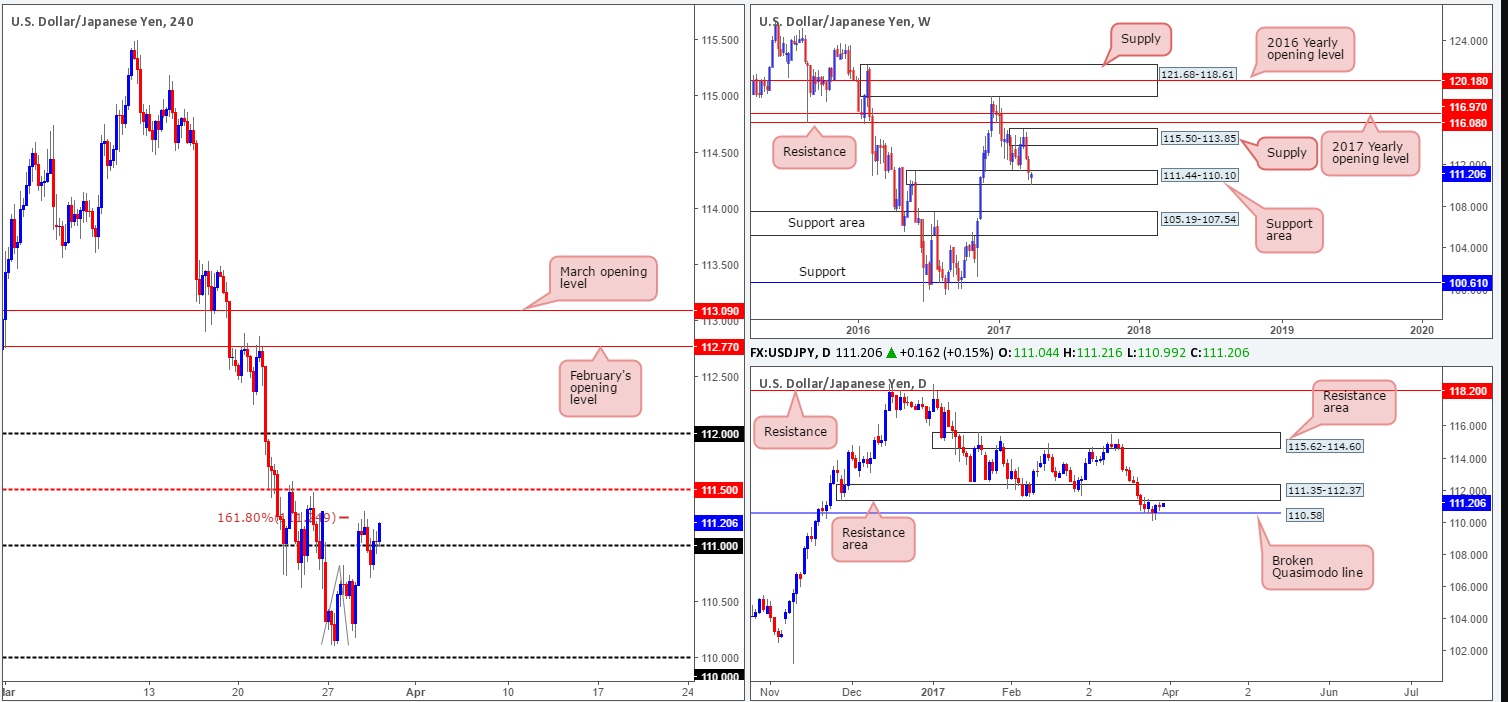

Thursday 30th March: Technical outlook and review

A note on lower-timeframe confirming price action… Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the … Continue reading Thursday 30th March: Technical outlook and review