Updated October 2020 Despite their popularity, CFDs, or contracts for difference, are relatively new products – their invention is widely credited to Brian Keelan and Jon Wood in the 1990s, of UBS Warburg[1]. CFD trading offers cost-effective access to global markets, all from one platform. CFDs are over-the-counter (OTC) leveraged products, derivatives that are designed … Continue reading Contracts for Difference: CFD Trading Explained

Category: Uncategorized

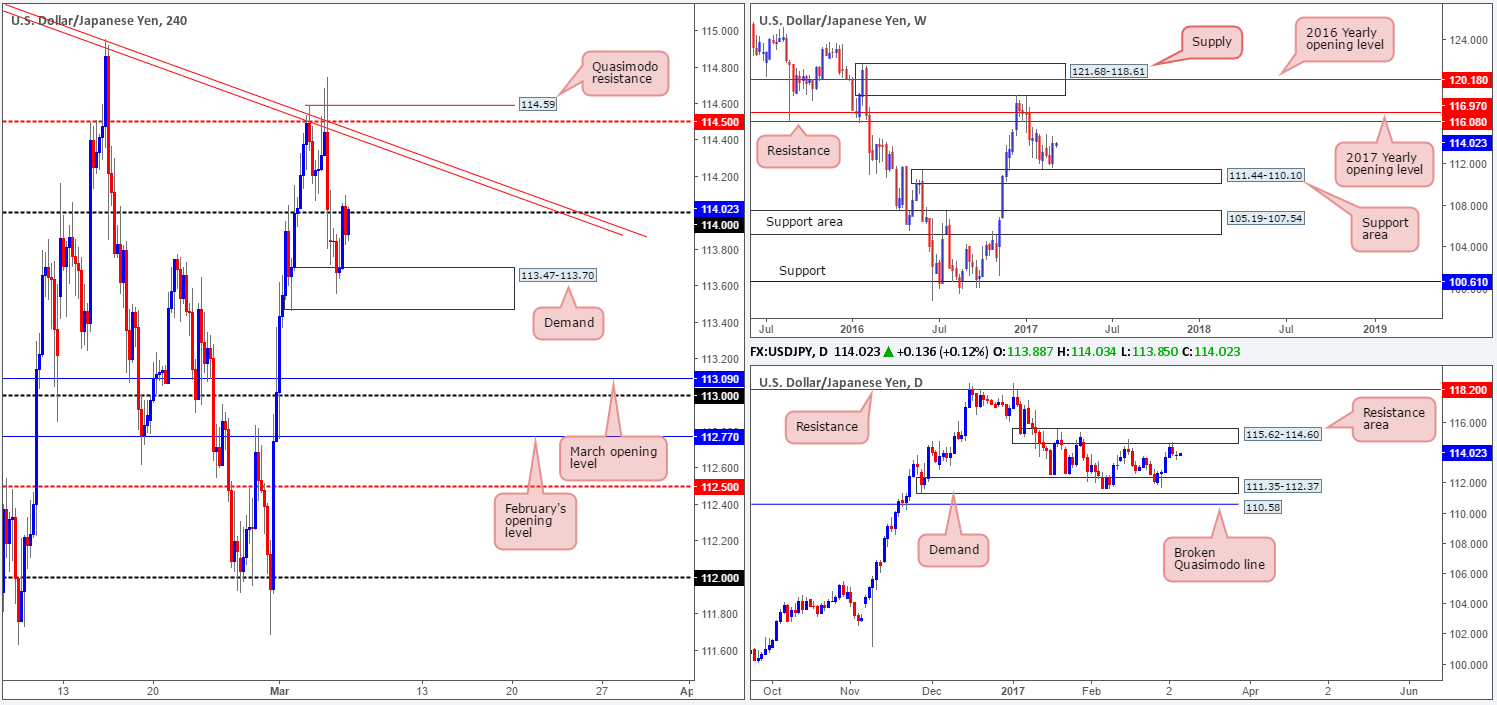

Tuesday 7th March: European Open Briefing

Global Markets: Asian stock markets: Nikkei down 0.20 %, Shanghai Composite lost 0.10 %, Hang Seng and ASX 200 both rose 0.30 % Commodities: Gold at $1226 (+0.05 %), Silver at $17.78 (+0.05 %), WTI Oil at $53.20 (-0.05 %), Brent Oil at $55.95 (-0.10 %) Rates: US 10-year yield at 2.49, UK 10-year yield … Continue reading Tuesday 7th March: European Open Briefing

Supply and Demand: Learn to Identify POWERFUL Reversal Zones

The past decade witnessed a new type of trading strategy surface that has become widely popular with forex traders. The energy behind supply and demand zones is well documented. The problem, however, is many traders fail to recognise the subtle nuances that help determine an area’s strength. The basics In a nutshell, supply and demand … Continue reading Supply and Demand: Learn to Identify POWERFUL Reversal Zones

Tuesday 7th March: Technical outlook and review

A note on lower-timeframe confirming price action… Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the … Continue reading Tuesday 7th March: Technical outlook and review